Ukraine crisis briefing

Powered by

Download GlobalData’s Ukraine Crisis Executive Briefing report

- ECONOMIC IMPACT -

Latest update: 16 September 2022

Data from the United Nations’ Refugee Agency indicates that a total of 7.2 million refugees from the Ukraine had been recorded across Europe.

It is becoming clear that sea shipment volumes from Ukraine are much lower than previously. Looking further ahead, some reports suggest up to 30% of Ukrainian farmers will not plant winter crops.

Global economic growth to slow

GlobalData now forecasts that the world economy will grow at just 2.9% in 2022, following 5.9% growth in 2021.

Inflation rate set to rise

The global inflation rate is now projected to rise to 8% in 2022 from 3.5% in the previous year, up from 7.5% in the last report.

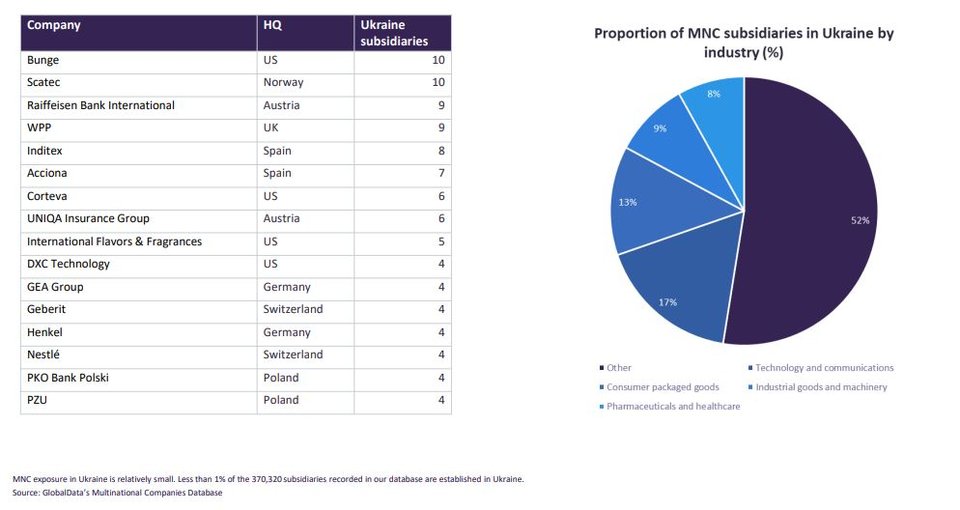

// Asterisk (*) denotes the company HQ is in a country imposing economic sanctions on Russia. Companies with HQ in Russia are not included in these charts.

- SECTOR IMPACT: MINING -

Latest update: 16 September 2022

PRODUCTION IMPACTS

Russia is among the top three producers of diamond, gold, platinum group metals and nickel. It is also a key supplier of seaborne and met coal to European markets, and iron ore, steel and aluminium to the wider world. Meanwhile Ukraine, is principally a supplier of coal, iron ore, and uranium, though in each case its share of global production is small.

RUSSIAN INDUSTRY

Of the leading miners, Nornickel initially stated that operations were continuing and in May confirmed supply of palladium and nickel sales were unaffected with no change to its 2022 guidance. However, while not directly affected by sanctions, it is adjusting its supply routes.

AUSTRALIAN IMPACTS

Linked to Australia's response to the war, Rio Tinto severed ties with Russian businesses and took sole control over Queensland Alumina which operate an alumina refinery in Australia, in which Rio owns 80% and Rusal 20%. Rusal has since filed a lawsuit to win back access to its share.

CANADIAN CONSEQUENCES

In March, Canadian miner Kinross announced that it was suspending all activities in Russia, including its Udinsk development project in Khabarovsk Krai, and operations at its Kupol gold mine. Further to that, in June 2022 it sold its operations to Highland Gold Mining, one of the larger gold producers in Russia, for $340m.