Deals in brief

Powered by

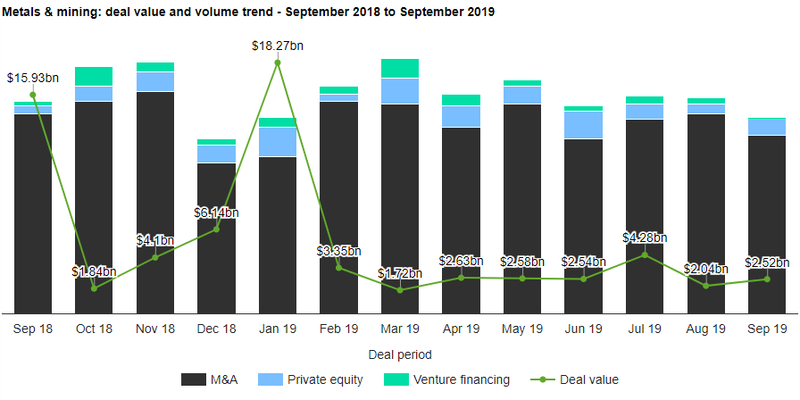

Metals & mining industry deals in September 2019 total $2.52bn globally

The value marked an increase of 23.6% over the previous month and a drop of 53.8% when compared with the last 12-month average of $5.45bn.

In terms of number of deals, the sector saw a drop of 10.7% over the last 12-month average with 100 deals against the average of 112 deals.

In value terms, Asia-Pacific led the activity with deals worth $1.37bn.

Metals & mining industry deals in September 2019: Top deals

The top five metals & mining deals accounted for 67.5% of the overall value during September 2019.

The combined value of the top five metals & mining deals stood at $1.7bn, against the overall value of $2.52bn recorded for the month.

The top five metals & mining industry deals of September 2019 tracked by GlobalData were:

1) Beijing Haohua Energy Resource’s $442.81m acquisition of Ningxia Hongdunzi Coal Industry

2) The $408.55m acquisition of Shanxi Meijin Energy by Shanxi Jinmei Distressed Equity Investment Partnership

3) GSO Capital Partners’ $350m private equity deal with Genesis Alkali Holdings

4) The $254.73m acquisition of Barkerville Gold Mines by Osisko Gold Royalties

5) Gamut Capital Management’s private equity deal with American Axle & Manufacturing Holdings for $245m.

Mandalay agrees sale of Challacollo project in Chile

Mandalay Resources has signed a definitive agreement with Aftermath Silver to sell its Minera Mandalay Challacollo (MMC) project. Challacollo is an epithermal deposit which hosts silicic volcanic and associated sedimentary rocks in the Cretaceous Challacollo Volcanic Complex. The total deal is valued at C$10m ($7.5m).

China’s Jingye Group to buy UK-based British Steel

Chinese industrial giant Jingye Group has agreed to buy the business and assets of bankrupt British Steel for an undisclosed sum. The deal comes after Jingye and the UK Government’s Official Receiver signed contracts related to the sale. The acquisition, which is worth approximately £50m, could safeguard 4,000 jobs, reported The Guardian.

Bushveld closes acquisition of Vanchem Vanadium Products

Vanadium producer Bushveld Minerals has announced the completion of all outstanding conditions with respect to the acquisition of Vanchem Vanadium Products (VVP).

Seriti to acquire 91.835% stake in South Africa Energy Coal

Seriti Resources has concluded an exclusive acquisition agreement to acquire a 91.835% stake of South32’s South Africa Energy Coal (SAEC) thermal coal business. Following a competitive bid process, Seriti first signed exclusive negotiations to acquire the SAEC business in August. The remaining 8.165% interest in SAEC will be held by a consortium led by the Phembani Group.

Albemarle completes $1.3bn lithium joint venture with MRL

US company Albemarle has concluded the transaction with Mineral Resources Limited (MRL) under the asset sale and share subscription agreement. The agreement was initially signed on 14 December 2018 and amended on 01 August 2019. The 60:40 joint venture (JV) between Albemarle and MRL is named as MARBL Lithium JV (MARBL).

TerraCom to acquire substantial stake in Universal Coal

Australia-based coal miner TerraCom has signed a binding agreement to purchase a substantial stake in coal mining firm Universal Coal. Under the terms of the binding agreement, TerraCom intends to purchase approximately 19.9% of the issued capital of Universal from Coal Development Holding for a combination of cash and TerraCom shares.