Enthalpy’s Capital Investment System- Making the Right Investment Decisions

One bad project can destroy the investment benefits of ten good projects.

Investment decisions to develop or acquire new mining capital assets should be made on complete information evaluated via a feasibility process; this information is never final due to uncertainty; no investment decision is without risk.

Enthalpy are project structuring and execution experts.

Scroll down to read the article

To grow or sustain a business, investments must be made. The challenge is to decide how much of shareholders’ funds should be put at risk, prior to the investment decision, in seeking to define the investment. The alternative is to take higher risks during the delivery of the development project or purchase of the existing business or asset.

Too many examples of investment decisions which did not deliver the promised values have been witnessed in the resource and industrial sectors. Two fundamental aspects underlie such unfavourable outcomes:

(a) The investment decisions were made on flawed or inadequate evaluations; or

(b) The new project developments or acquisitions were not delivered to the evaluations made; or

(c) Both (a) and (b) occurred.

Failures in successfully delivering new projects or acquiring assets or businesses are the subject of continual developing skills. The Capital Investment System (CIS) addresses the first of these issues.

For any shareholder to agree to put funds at risk, an evaluation of the costs and risk reward must be made so that an informed decision can be made. The evaluation then becomes the determinant as to the level of risks and the accuracy of the forecast of outcomes.

The logic is clear. More shareholder funds spent evaluating an investment will normally result in a greater level of accuracy. The questions then become how much to invest, and how to go about the process, to get a defined quality of decision making information.

What is the Enthalpy Capital Investment System

The CIS is a methodology for achieving the successful delivery of investment outcomes. The CIS:

- Is a system used for investigating, recommending and executing capital investments;

- Uses principles and processes widely accepted throughout the mining industry and project management bodies;

- Defines the standards for studies, projects and commercial transactions.

Built up through 30 years of ‘real world experience’ our CIS enables clients to understand the risks associated with large project investments. |

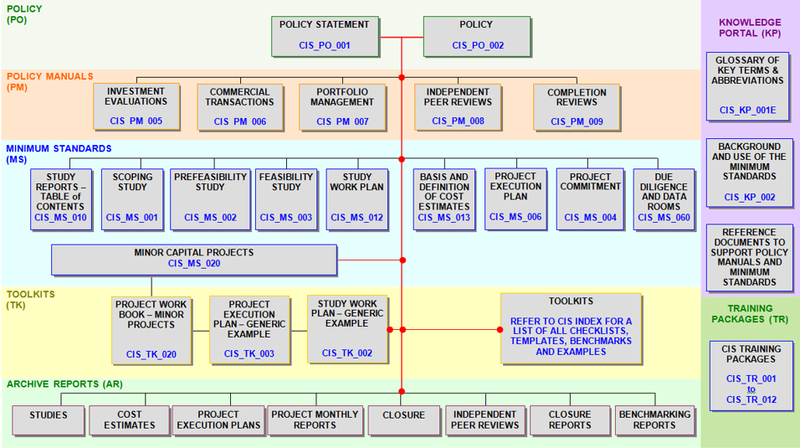

The Capital Investment System Structure

The CIS provides simplicity and consistency throughout asset delivery, leading to better predictability and competitiveness for our Clients. |

Top 10 Benefits of the Capital Investment System

- Comprehensive, consistent and rigorous reviews of investments – technical and commercial

2. Streamlined investment process

3. Developed plans and capabilities to manage risks

4. Understand the risk to reward balance of the investment prior to commitment

5. Provide confidence to decision makers

6. Sustainable assets and businesses that align with business strategy

7. Optimise investment choices; the portfolio approach

8. Progressive and supported decision making.

9. Encourages and enforces good planning of studies and projects

Clear known processes, rather than having to rely on personal judgements

Who we’ve assisted with Our Capital Investment Systems

Over the past 30 years, Enthalpy has worked internationally with the following mining and energy companies to implement a successful CIS; we’ve helped them set up systems that allow them to invest in the right projects. | |

|

|

The CIS and processes used by a Company are critical to the competitive edge of any business. Every year, the demands for greater effectiveness from shareholder funds will increase as this is a natural evolution found in business.

Lessons must be learnt continually and improvements made, as recent lessons show the importance and benefits of having in place well defined processes, structures and minimum standards. A CIS has such a low cost to establish and it is insignificant relative to the reduction in risks.

A defined Capital Investment System will increase shareholder confidence when making investment decisions, while yielding a reduction in project disasters (never assume the system will totally eliminate). The processes and structures will lead to improvements in the cost effective use of development funds, and give consistent management and more disciplined decisions.

This article in an excerpt from a Paper written by Enthalpy’s Chairman, Neil Cusworth, for the Project Management Institute.

Contact information

Contact us to find out more about how Enthalpy can assist with your investment governance and next major investment decision.

Head Office

+61 7 3844 0245

Level 46, 111 Eagle Street Brisbane QLD 4000 Australia

Website: www.enthalpy.com.au

Email: enquiries@enthalpy.com.au

Brisbane, Melbourne, Perth

London, Santiago Johannesburg, Enthalpy North America